In El Cajon, CA there is a mix of property types present with most being residential, schools, parks, or commercial. While a wider range of living areas are present, most single family residences range in living area size from 975 Sqft to 2,966 Sqft, with the most common being approximately 1,500 Sqft. 12% of neighborhood single family residences are larger or equal to the subject property in living area size, 88% are smaller or equal to the subject property in living area size, 53% are newer or equal to the subject property in age, and 49% are older or equal to the subject property in age. Most properties (85%) have 3 or 4 bedrooms, and most properties (61%) have 2 or 2.5 bathrooms. Most single family residences range in year built from 1955 to 1992 with the most common year built being 1960. Views are present in the neighborhood and Realtors report that 68% of all single family residences have them. The views include: bay, city, evening lights, golf course, greenbelt, lagoon/estuary, lake/river, mountain/hills, ocean, and panoramic. Public and private services, conveniences, and employment are typical of population centers throughout the county.

MARKET CONDITIONS

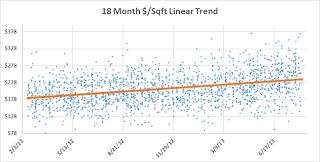

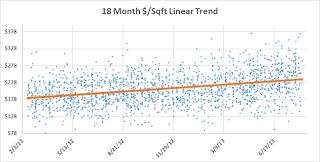

In El Cajon, CA, and as of the 12 month period ending 08/12/2013, single family residence sale prices ranged from $50,000 to $2,125,000, with a median of $364,000. The median sale price changed 20.3% over the past year indicating an 'increasing' property values trend. The median $/Sqft changed 18.6% over the past year indicating an 'increasing' property values trend. There are currently 2.26 months of housing inventory indicating a demand/supply trend of 'in balance'. The median market exposure time over the past 60 days was 13 days. Based on recent-past market exposure times, I anticipate that the typical/median marketing time will be under 3 months over the coming 90 days. Property value trends may be misleading due to a decreasing ratio of bank sales and short sales, and an increase in the ratio of renovated properties.

Click Charts for Larger Versions

Click Charts for Larger Versions

Brian A. Ward

(619) 630-9273

Real Estate Appraisal Services For:

Real Estate Appraisal Services For:

· Bankruptcy

· Divorce / Marriage Dissolution

· Estates

· Trusts

· Date of Death / Retrospective Appraisals

· Expert Witness Testimony

· Before Buying and/or Obtaining a Mortgage (critical)

· Before Selling

· Property Tax Appeals

· Intra-Family Home Purchases and Sales

· More!